NEWS

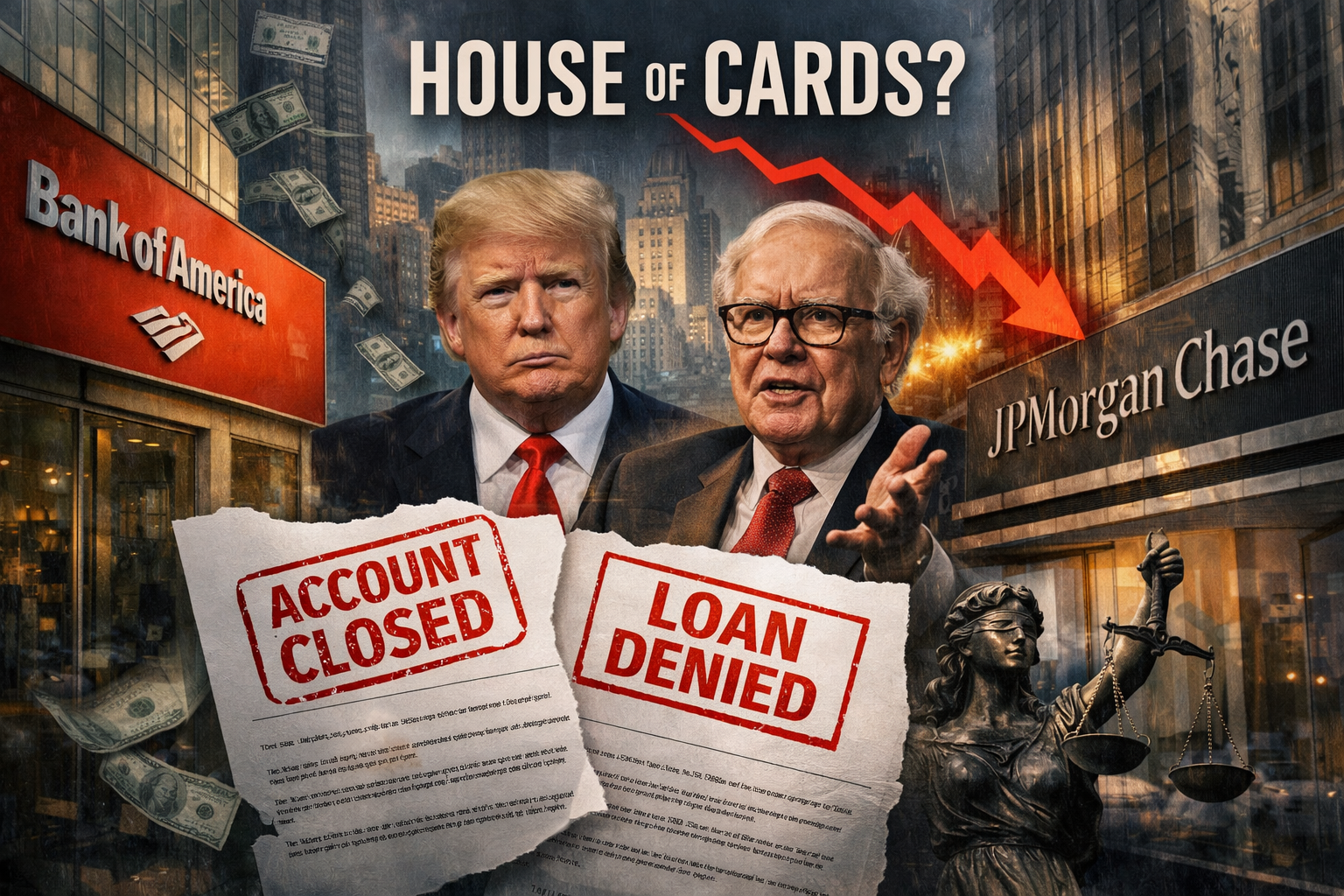

BREAKING: Major U.S. Banks Sever Ties with Trump Organization, Citing “Unacceptable Legal Risk”; Buffett Warns of “House of Cards”

In a stunning development that has sent shockwaves through political and financial circles, several major U.S. banks have reportedly cut ties with the Trump Organization, citing what insiders describe as “unacceptable legal and reputational risk.” The move marks one of the most significant financial rebukes yet faced by former President Donald Trump’s business empire—and it comes amid renewed warnings from legendary investor Warren Buffett, who has allegedly described the situation as a “house of cards.”

Banks Pull the Plug

According to sources familiar with the matter, top-tier financial institutions have either declined to renew existing lending arrangements or have quietly exited relationships with Trump-linked entities altogether. Executives within these banks are said to be increasingly wary of the mounting legal challenges surrounding the Trump Organization, ranging from civil fraud judgments to ongoing investigations and compliance concerns.

Behind closed doors, risk committees are reportedly concluding that continued association with Trump’s businesses no longer makes commercial sense. The concern is not just about potential financial losses, but also regulatory scrutiny and brand damage in an era where environmental, social, and governance (ESG) considerations weigh heavily on corporate decision-making.

One banking source summarized the mood bluntly: “The legal exposure is too high, the unpredictability too great. This is not normal counterparty risk.”

A Financial Squeeze with Political Implications

The severing of banking relationships could have profound consequences. Large real estate operations, like those historically run by the Trump Organization, depend heavily on access to credit, refinancing options, and cooperative lenders. Without mainstream U.S. banks willing to engage, Trump-linked businesses may be forced to seek financing from smaller institutions, foreign lenders, or private equity firms—often at significantly higher costs.

Critics argue that this development undercuts Trump’s long-cultivated image as a powerful billionaire dealmaker. Supporters, however, insist the banks’ actions are politically motivated, framing the move as part of a broader effort by elite institutions to marginalize Trump ahead of future elections.

Buffett’s “House of Cards” Warning

Adding fuel to the fire is a reported warning from Warren Buffett, one of the most respected voices in global finance. Buffett has long cautioned against opaque business structures, excessive leverage, and enterprises that rely more on confidence than fundamentals. His alleged description of the Trump financial situation as a “house of cards” has been widely interpreted as a broader critique of business models propped up by debt, branding, and constant refinancing rather than sustainable cash flow.

While Buffett did not name the Trump Organization directly in public remarks, market observers say the reference was unmistakable given the timing and context.

Trump Camp Pushes Back

Unsurprisingly, the Trump Organization has pushed back strongly, dismissing reports of financial isolation as exaggerated or false. Spokespersons argue that the company has “multiple financing options” and remains “financially strong,” insisting that political hostility—not business reality—is driving the narrative.

Trump allies have also accused Wall Street of hypocrisy, pointing out that banks have historically financed companies with far more controversial records when profits were at stake.

Bigger Than Trump?

Beyond the former president himself, the episode raises uncomfortable questions about the intersection of politics, finance, and power in the United States. When major banks collectively decide a figure is too risky to touch, is that prudent risk management—or a form of soft economic sanction?

For now, what is clear is that the walls appear to be closing in financially. As legal battles continue and credit lines tighten, the Trump Organization faces one of the most challenging periods in its history. Whether it adapts, finds alternative backers, or sees parts of its empire unravel remains to be seen.

One thing, however, is undeniable: when the banks walk away, the message is loud—and the warning unmistakable.